The hardest part of entrepreneurship is to know when it’s time to change direction, to pivot, and when it’s time to stay the course.

Foremost, you must be able to distinguish between internal operating problems, and external problems of the product in the marketplace.

The first requires improving competence and processes of the team, the second requires a product pivot.

Signs That You Need to Pivot

Product management in competitive marketplace, like the Art of War, involves tactics, strategy and vision.

When a product has problems competing, the first signs are in everyday tactical work.

From tactics to vision, here are signs to look for in the product management processes.

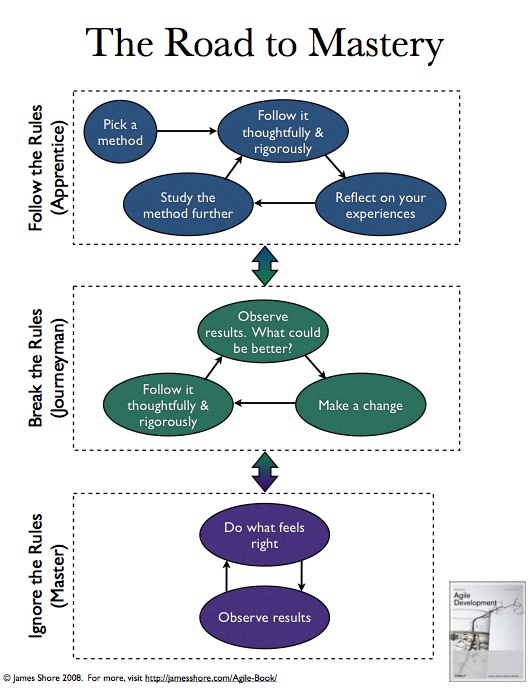

Scrum & Agile Development

When a product falters in the marketplace, Key Performance Indicators (KPIs) and other analytical measures will flatten or start dropping

The KPIs can drop in spite of product improvements. Completion of projects in the product’s agile backlogs may not bring the expected improvements.

Scrum and Agile are the most effective in prioritizing and completing projects in collaboration with all the product’s stakeholders. The agile processes are, however, poor in diagnosing more strategic and vision problems

UX Redesign

Research and testing with Users is the first step in fixing issues with an under-performing product.

Collaborative design with mixed skill teams, which include User feedback, is the backbone of UX design.

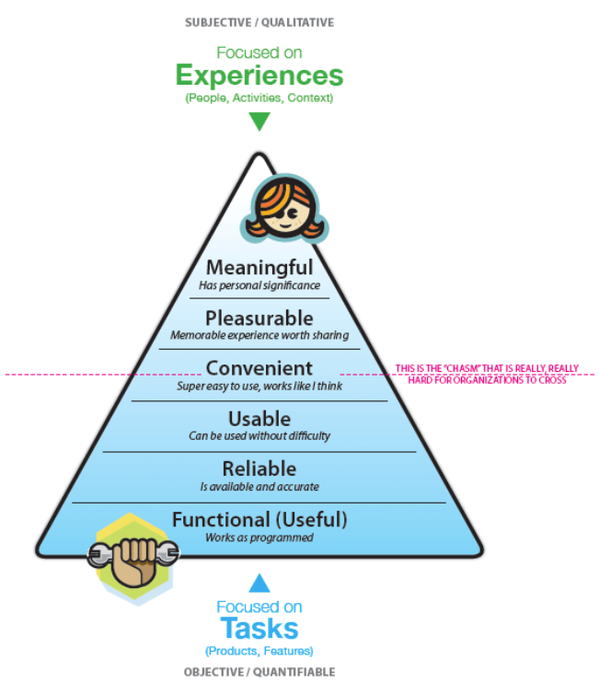

UX addresses usability, product identity & narrative, branding, aesthetics, gamification improvements. Improvements in the entire design stack, shown in the graph, are tested with users to validate the work.

The UX design team must, however, recognize when a product’s problem are beyond the scope of just improving the User’s Experience.

A wider view, which includes the marketplace, is needed to solve the product’s problems.

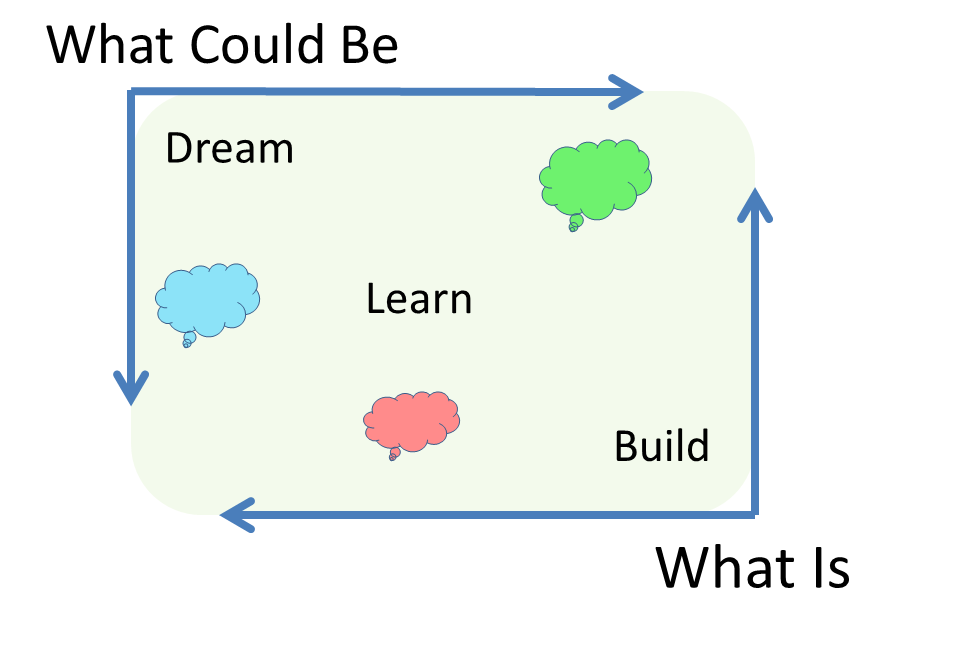

Lean Startup

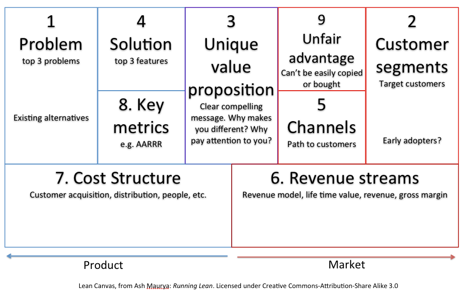

The business canvas is the best way to map out the immediate strategic issues of a product

The lean startup and customer development, are excellent methods to collect information for the Business Canvas.

The processes build lightweight prototypes/modifications and measure User’s reactions to when using them. Lean startup is able to prioritize the weakest areas and riskiest assumptions in the business canvas, and establish the cause of a product’s weakness,

When a product’s vision still has full potency, these build-measure-learn iterations are sufficient for small change pivots, like price, narrative and re-targeting customer segments.

Based on the business canvas, a lean startup team can establish, also, when a product’s problems are beyond their responsibility.

Design Thinking

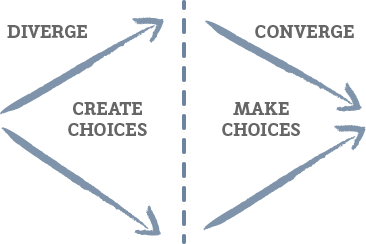

When a product’s problem are beyond quick build-measure-learn iterations. Questions of vision and purpose may come into play. The framework for a possible solutions expands beyond a business canvas.

A more extensive user research project, a full ethnography, may be needed to understand the User’s full daily environment. An ethnography enables a wider exploration of the problem domain.

Design Thinking provides processes and people culture to explore a wider area of ideas. The product’s situation can be mapped, studied through ideation, prototyping, user testing and other creative methods.

Design thinking always starts by framing the problem, defining a goal, including time-frames and constraints. The design thinking team can, also, identify when and how a product’s problems are beyond the scope of their fixing.

Entrepreneurship

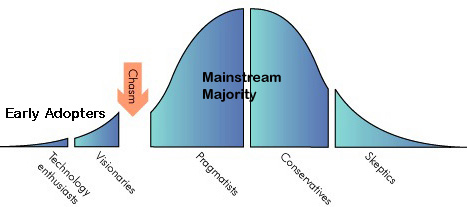

In spite of well established methodologies, products fail all the time.

The best product management teams in the world cannot fix a depreciated product vision. Usually, the breadth of pivot required exceeds their framework of competencies.

Entrepreneurs, however, continually create products that disrupt markets, even without the help of formal methodologies.

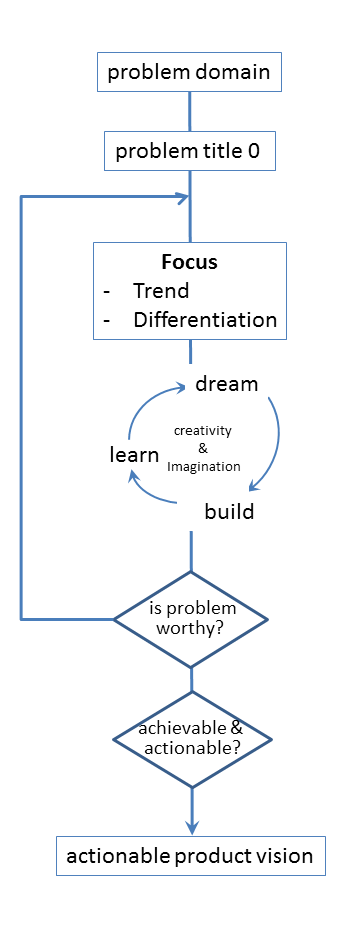

Hence, once the product’s vision has lost potency, the product’s founders must create a product vision anew. The owners must embark on an entrepreneurial big pivot.

The new product vision must show how to make the product original & valuable again, how to achieve a unique differential in the marketplace .

.

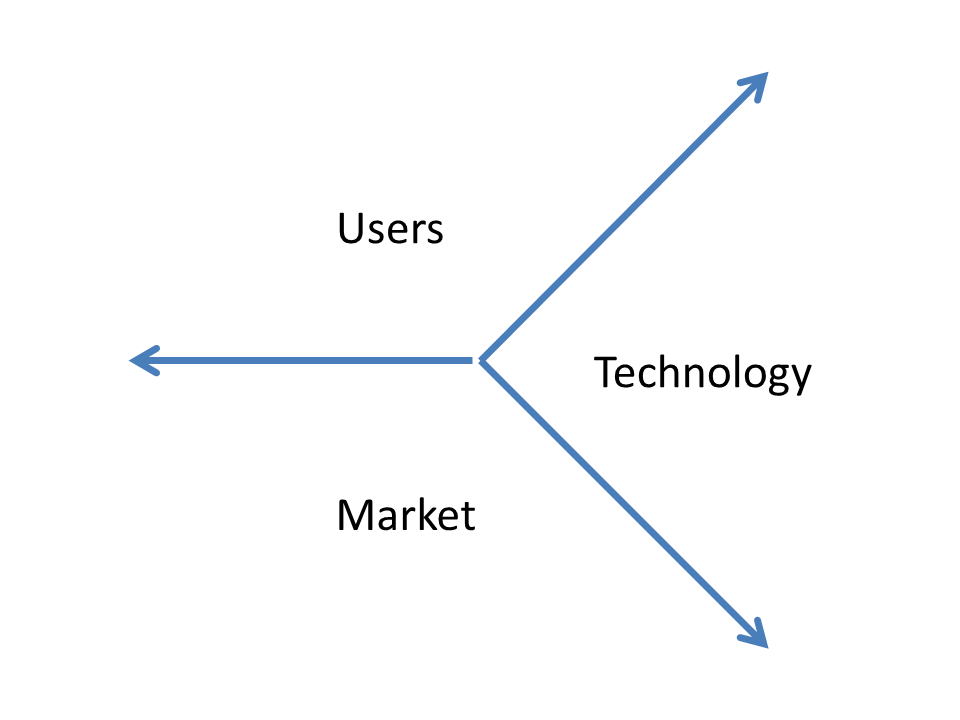

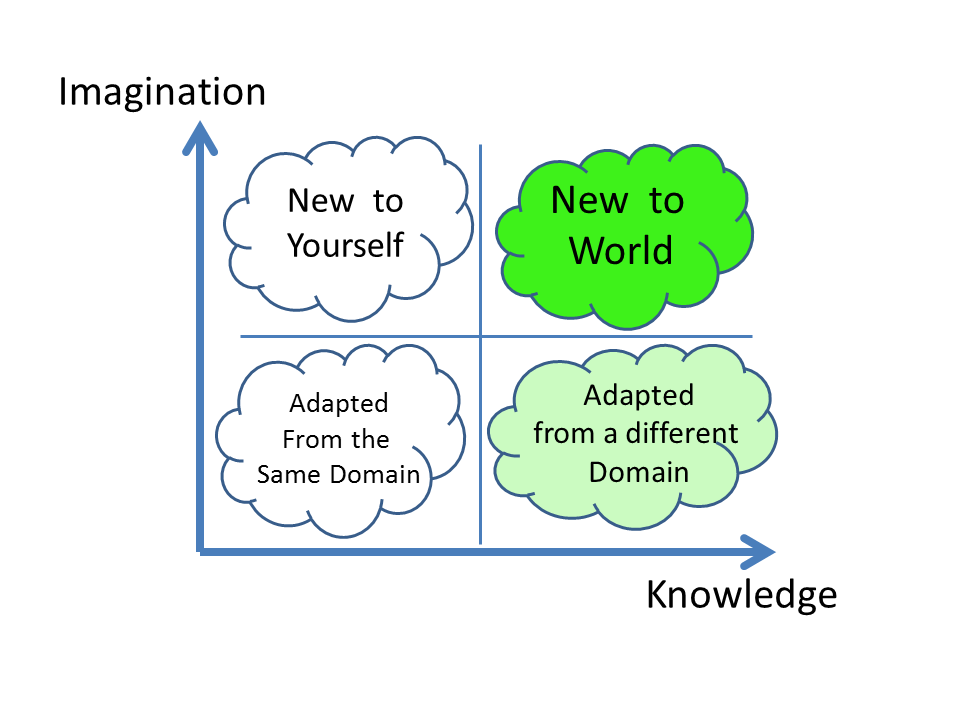

Clearly, entrepreneurs operate on a wider vision of the market place. The widest understanding of the context for a product.

The broadest context canvas is “USER”, “TECHNOLOGY”, and “MARKET”, as shown. The most common forms of product failure, for example, can described as follows:

- USERS: no differential utility

- TECHNOLOGY: will take several decades to mature

- MARKET: squeezed out of the value chain by bigger players

The Art of Entrepreneurship

A big pivot, an entrepreneurial project, has the widest framework and freedom from constraints allowable. The bigger the problem perceived by the product team, the wider the allowances made to the big pivot team.

The art of the pivot is combining the freedom and the constraints. A

judicious blend of bottom-up experimentation and top-down guidance.

| Freedom | Constraints |

| Bottom-Up | Top-down |

| Original | Valuable |

| Exploratory | Procedural |

| Ideation | Synthesis |

| Problem Focused | Tools Focused |

| Problem Pulls | Method Pushes | Discover | Exploite |

| Rebel | Collaborate |

| Interesting | Useful |

| Disobedient | Disciplined |

| Disregard | Orthodoxy |

| Random | Incremental |

| Unpredicatable | Methodical |

| Irreverant | Doctrinal |

| Open Mind | Dogmatic |

| Un-grounded | Reasoned |

| Beginner | Expert |

| Experiment | Look It Up |

| Improvise | Analyse |

| Self Learning | Educated |

| Wonder | Measure |

| Move On | Acumulate |

| Challenge | Comply |

| Defiance | Conforming |

The rules of engagement of the pivot team is freedom w

ithin the agreed framework.

A part of entrepreneuship is an art which cannot be taught, Steve Blank, Stanford University

The pivot team is best composed by those most exposed to changing externalities (technology, shifting user base, strategic competitors).

Also choose the specific domain experts, those with the know-how which creates the most differential for the company.

Usually, the founders are in this group.

Framing and Constraints

Frame your pivot as solving a worthy problem for the User. A worthy problem is naturally original, and valuable to users.

A big pivot must be risky and uncertain. It is a law of nature with worthy problems.

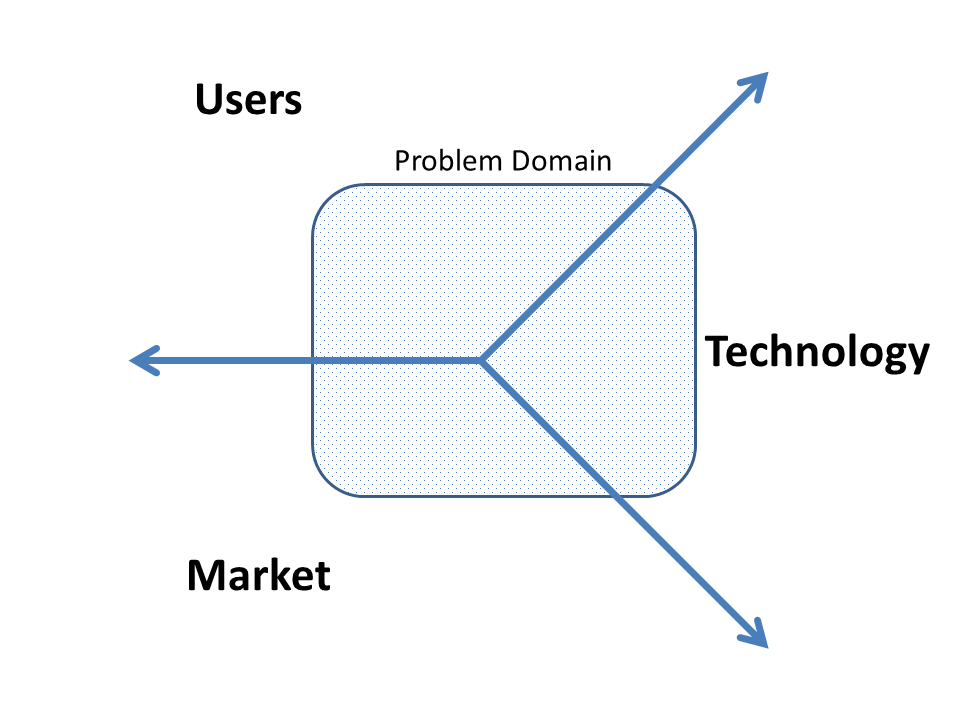

The key here is the problem domain’s know-how. The most expensive asset. Know-how about the Users, the Technology and the Market in the problem domain is essential to build and explore.

Even a random bottom-up exploration needs the know-how to (1) build and solve small problems, (2) avoid re-inventing the wheel, and (3) perceiving an out-of-the-ordinary outcome.

You must frame your problem domain in accordance the resources, the know-how and time your have to explore it. Otherwise, you will find yourself trying to swallow an ocean.

Choose a problem domain you have a passion and know-how for. Big pivots are long term endeavours of indeterminate length. Think of it as a at least a 3 year commitment. It is likely you will achieve success on the 2nd or 3rd bounce of the ball.

Grass is greener projects maybe attractive initially but the effort and time required to achieve a critical mass of problem specific know-how will be considerable.

The narrower the focus of the project, the more specific the User’s problem, the more feasible the exploration.

Start Learning

Unbiased exploration within the problem’s framework is most critical here. Unconscious assumptions, cognitive biases, existing expectations guarantee failure.

An empirical approach, where you make, build and user-test is best in suspending prejudices, and perceiving truly. Thinking with your hands is the good approach to finding original problems.

Use bottom-up, individual sample of problems within the framework, with a strong disregard of established expectations. Use the small problems as an opportunity to learn the problem domain, and actively look for unexpected outcomes, failures and opportunities.

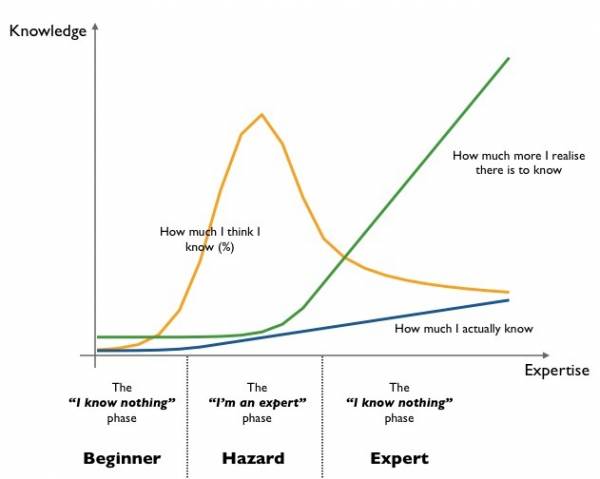

You must pull knowledge in, learn what you need, to solve the problem at hand. It is problem-driven, self directed learning.

The ability to pull knowledge as needed is what distinguishes

product professionals, from classic specialist professionals. Department, function centered staff, like programmers, designers or salesmen, study the tools, methods and processes of their profession. Product focused professionals are discipline agnostic, and learn only to better the product outcomes.

Self directed learning is not easy. Every discipline, department and community you approach will consider you a beginner. It requires a beginner’s-mind, humility and self confidence.

Diversity through team work can enable discipline agnostic work. Know-how is best shared through prototypes and visual thinking.

Rules of engagement are important when working collabo ratively with people from diverse backgrounds. Blending the arbitrary, random, discovery work with the discipline to build and test requires an understanding and an agreement of the overall process.

ratively with people from diverse backgrounds. Blending the arbitrary, random, discovery work with the discipline to build and test requires an understanding and an agreement of the overall process.

Map Your Progress

Visual thinking is a well known technique for avoiding biases and perceiving truly. A project wall with post-its, pictures, and graphs is a great way to make connections between different experiments, studies and map and re-map along interesting trends.

The know-how that will make a difference will not be generic. It has to be problem specific, and combined from diverse areas:

Looking & Observing

KNOW-HOW

- Do you have enough know-how?

- Are there enough post-its on the project wall?

- Are you sampling the problem area well?

- Are you working outside the problem domain?

- Should you redefine the problem domain?

- Are you covering enough perspectives, enough disciplines, enoug

h user segments?

h user segments? - Is there a different discipline or specialist that could contribute to the problem?

- Are prototypes failing because you don’t know?

IMAGINATION

- Is there originality, randomness, exploration?

- Is the exploration too methodical?

- Is there too much groupthing?

- Are you breaking any rules?

- Have you built anything yet?

- Are the prototypes heading to new areas?

- How many of the prototypes failed?

- Are the prototypes bringing anything new?

- Are you having fun with the prototypes?

ORIENTATION & SEEING PATTERNS

- How are the ideas, post-it notes, clustering?

- Any ideas outside classical, orthodox disciplines and specialisms?

- Any cluster of ideas cross-pollinating?

- Can you draw a any spectrums, low to high, on the project wall?

- Does clustering ideas along the value chain show patterns?

- Are you finding a User Segment focus?

- Is there a disruptive Technology?

- Is there anything un-expected?

- What is irritating?

- Do any of the prototypes have traction?

- Is anything not making sense and why?

Action

- Is the framework too wide?

- Is the framework too narrow?

- Does the problem domain need to be moved along either the User, Market, Technology axis

- Are there too many competitors?

- Is this problem domain too old, too mature?

- Do any of the prototypes have interest?

A Game of Know How

Reaching Critical Mass of Focused Know-How

Know-how is bed-rock. Intuition is possible only with enough domain know-how.

Accumulate enough focused know-how and perception of possibilities multiplies a thousand fold. Past a critical mass of focused know how, and creative output explodes.

Accumulating focused know-how is frustrating though. How much is enough? Is this enough? When does it finish? The narrower your focus, the quicker you will go up the learning curve. So focus down.

The most reliable form of innovation is extending ideas and patterns from an unrelated domain. This form of innovation requires high know-how levels, you must master several domains before you can visualize parallels.

Have You Reached Problem Domain Mastery?

How do you measure problem domain competence?

Have you failed, or do you continue the learning process?

The difference between beginner and master is awareness of context, the true size of the problem framework. The expert knows how much he does-not-know.

Mastery is when domain of expertise becomes second nature. You are not conscious of the rules, methods or tools. You just perceive, build, talk, play without a second thought or effort. You are native to the problem domain.

Can you do things in the problem domain others cannot?

The Mythical Man-Month

The truth is adding more people to a team does not speed up or help know-how intensive tasks – The Mythical Man-Month.

Though diversity and open emergence of ideas are essential, problem domain know-how is still required for team members.

A pivot team must be composed of domain experts, each in their own field. T-shaped experts are recommended.

And a Lot of Luck

Entrepreneurship is, also, about being in the right place at the right time.

The best venture investment teams in the world score 1 in 10 as sustainable companies, and 1 in 1000 companies reach their target investment returns.

Entrepreneurship is not like a job. Often it is an all or nothing bet.

The Efficient Market Theory

The efficient market theory (Nobel Prize, Merton & Scholes, 1997) states that when more than 10,000 people are examining a market with equality of information, you can no longer outperform the market. Market is risk-reward efficient.

Sometimes, the market is just too crowded, and the problem domain know-how has become a commodity.

Your domain know-how has become generic. A big pivot is not possible within the old framework. It is time for the entrepreneur to move on.

No Shortcuts – Beware Strategy Schools

Beware “descriptive” strategy methods from Business Schools.

“Descriptive” methods are good for describing what HAS happened. But useless at deciding what to do. Great post-event, bad pre-event.

Michael Porter’s “Competitive Advantage”, Kim & Mauborgne’s “Blue Ocean Strategy” are two such popular descriptive methods. Excellent for explaining success or failure AFTER the event.

“what got you here, will not get you there”

Descriptive methods fail because they rely on historical knowledge, past history. Extrapolating the past does not work in efficient markets.

“Prescriptive methods” provide a process to learn new knowledge. To find a new differential in the market. Prescriptive methods are exploratory.

“Prescriptive methods”, on the other hand, give you a process, a framework, for what-to-do-next. Processes like Lean startup, Design Thinking, OODA Tactical Loops, visual thinking are “prescriptive”

Focus, Focus, Focus

As you quest forward, your framework will narrow. Your quest will converge within the framework.

Searching for a worthy problem is like panning and sluicing gold paydirt, looking for nuggets. Focus is the narrowing down to the promising areas.

Focus, the ability to disregard areas, to say no to problems is a joy when it arrives. It arrives in moments of intuition, in fits and starts.

Focus, unfortunately, is fickle and often comes wrapped in doubt. By narrowing down, are you stepping past a worthy problem?

You can never have enough focus. The more limited your means, your time, your assets, the more you need a hard focus

REFERENCES

PROBLEM FOCUS & DOMAIN KNOW-HOW

- Anti-disciplinary, Joi Ito

- Simplicity on the Other Side of Complexity, Jon Kolko

- Understanding a Problem Better than Anybody Else, Chris Dixon

- Generating Startup Ideas, Marc Barros

- The Role of Domain Experience, Marty Cagan

- Finding Your Edge, Alice Bentinck, Entrepreneur First

- Complexity and the 10,000 Hour Rule, Malcol Gladwell

- The Problem with Design Thinking, Tim Malbon

- There is no such thing as the perfect idea, Alice Bentinck

- The Secrets Behind Many Successful Startups, Vinicius Vacanti, Yipit

- Beyond Agile and Lean, Marty Cagan, SVPG

- How to be an Expert in Changing World, Paul Graham

- Etsy CTO: We need Software Engineers, Not Developers, John Allspaw

CREATIVITY & ORIGINALITY

- What Does Design Thinking Feel Like, Tim Brown, IDEO

- The Zag, Marty Neumeier

- Look, I Made a Think: Confidence in Making, Jon Kolko

- Illustrations by Hugh McLeod, Fair Use

- How to Get Startup Ideas, Paul Graham

- Why to Not Not Start a Startup, Paul Graham

- Before the Startup, Paul Graham

- Creative Confidence, Julie Zhuo, Facebook

- Creativity Inc, Ed Catmull, Pixar

- Startup Differentiation: You are the DNA of your Company, Peter Nixey

- Advice for Thriving in a World of Change, Joi Ito

- How Reframing A Problem Unlocks Innovation, Tina Seelig

- You’re working on the wrong idea, Alice Bentinck

- Leaders Can Turn Creativity into a Competitive AdvantageTim Brown, IDEO

- Roofshot Manifesto Luz Andre Barroso

- Surely You’re Joking Mr Feynman

VISION & MAPPING

- A Visual Vocabulary to Product Building, Dan Schmidt

- Using Situational Maps for Business Strategy: On Being Lost, Simon Wardley

- Framing your Search: Vision vs Hallucination, Steve Blank

- Founder’s Vision – Entrepreneuship is an Art, Steve Blank

- Product Evangelism: Sharing the Vision, Marty Cagan

- Missionaries vs Mercenaris: The Need for a Compelling Product Vision in Driving Product Teams, Marty Cagan

- Product Managers Must Understand Product Vision: Big vs Small Product Owners, Roman Pichler

- How do You Find the Secret for your Product, Peter Thiel

- Pivot, don’t jump to a new vision, Eric Ries, Lean Startup

- Get Clarity on the World Around You and Your Business with the context map, Erik Van Der Pluum, Design A Better Business

- Vision versus Hallucination – Founders and Pivots, Steve Blank

- When vision blinds traction, Stefano Zorzi

- How to Understand Your Market, Justin Lokitz, Design a Better Business

- You product is already obsoleteDes Traynor, Intercom

METHODS & TOOLS

- Developing Strong Product Owners, Marty Cagan

- Product Strategy in an Agile World, Marty Cagan

- Product Porfolio Management: Planning the Life of Your Products, Marty Cagan

- The Kano Model: Depreciation of UX Design Differentiators Over Time , Jared Spool

- Emergent Strategy: The Big Lie of Strategic Planning, Roger Martin, Harvard Business Review

- Change by Design, IDEO, Tim Brown

- Driving Corporate Innovation: Design Thinking vs. Customer Development, Steve Blank

- Well Designed: How to Use Empathy to Create Products People Love, Jon Kolko

- Lean Doesn’t Always Create the Best Products, Jon Kolko

- Be a Great Product Leader, Adam Nash

- Driving Corporate Innovation: Design Thinking vs. Customer Development, Steve Blank

- Agile vs Lean vs Design Thinking, Jeff Gothelf

- Where Lean Ends, Peter Nixey

- Beyond Lean and AgileMarty Cagan, SVPG

- The Tao of Boyd: How to Master the OODA Loop, Brett & Kate McKay

- Ethnography: When and how to useAndy Walker, Spotless

- Why anti-Lean Startups are BackDennis Mortensen, x.ai

- Why Innovating Is About Doing, Not Talking Diego Rodriguez, IDEO

STARTUPS

- Product Passion: What are you trying to achieve?, Marty Cagan

- Startup Playbook, Sam Altman, Y Combinator

- Big Ideas: Google’s Larry Page and the Gospel of 10x

- Why Founders Fail: The Product CEO Paradox, Ben Horowitz

- Why Startups are Agile and Opportunistic – Pivoting the Business Model, Steve Blank

- How to pivot properly — linear ideation, Alice Bentinck, Entrepreneur First

- Black Swan Farming, Paul Graham

- Why is it Hard to Bring Big Company Execs into Little Companies?, Ben Horowitz, A16Z